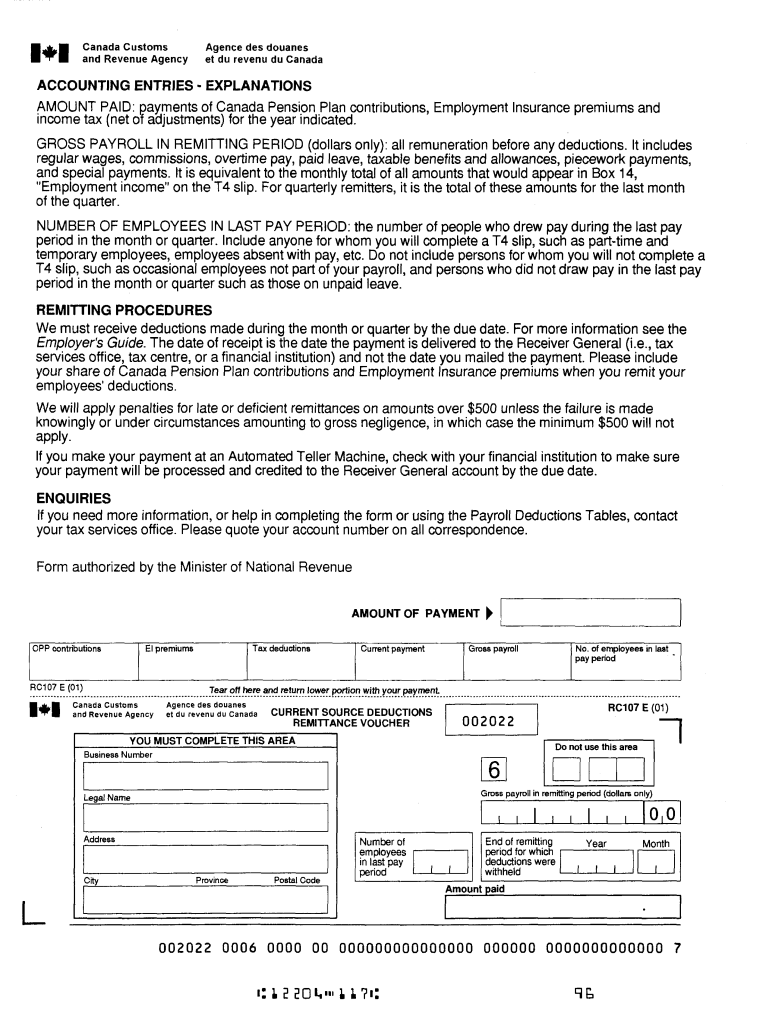

Payroll Remittance Form Sample 2001

What is the Payroll Remittance Form Sample

The Payroll Remittance Form, commonly referred to as the pd7a, is a crucial document used by employers in the United States to report and remit payroll taxes. This form is essential for ensuring compliance with federal and state tax regulations. It captures vital information regarding employee earnings, deductions, and the total taxes owed. The pd7a form serves as a record for both employers and tax authorities, facilitating accurate tax reporting and timely payments. Understanding this form is key for businesses to maintain good standing with tax obligations.

Steps to Complete the Payroll Remittance Form Sample

Completing the pd7a form requires careful attention to detail. Here are the steps to ensure accuracy:

- Gather necessary information, including employee details, earnings, and deductions.

- Fill out the form with accurate figures for gross pay, taxable benefits, and withholdings.

- Ensure that all calculations for federal and state taxes are correct.

- Review the form for any errors or omissions before submission.

- Submit the completed pd7a form by the designated deadline to avoid penalties.

Legal Use of the Payroll Remittance Form Sample

The pd7a form is legally binding when completed and submitted according to the guidelines set forth by the Internal Revenue Service (IRS) and state tax authorities. To ensure legal compliance, employers must adhere to specific requirements, such as accurate reporting of employee wages and timely remittance of taxes. Failing to comply with these regulations can lead to penalties, interest charges, and potential audits. Utilizing a reliable electronic signature solution, like signNow, can further enhance the legal validity of the form by providing secure signatures and an audit trail.

Who Issues the Form

The Payroll Remittance Form, or pd7a, is issued by the Internal Revenue Service (IRS) in conjunction with state tax agencies. Employers must obtain the form from the appropriate tax authority to ensure they are using the most current version. This ensures compliance with any updates to tax laws or reporting requirements. It is essential for businesses to stay informed about any changes that may affect the pd7a form and its submission process.

Form Submission Methods

Employers have several options for submitting the pd7a form. The most common methods include:

- Online submission through the IRS e-file system, which allows for quick processing and confirmation.

- Mailing a physical copy of the completed form to the appropriate tax authority.

- In-person submission at designated tax offices, which may provide immediate assistance and confirmation.

Choosing the right submission method depends on the employer's preferences and the urgency of the tax remittance.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the pd7a form can result in significant penalties. Common consequences include:

- Late filing penalties, which can accumulate over time and increase the total amount owed.

- Interest charges on unpaid taxes, which can further inflate the financial burden.

- Potential audits by tax authorities, leading to more scrutiny of the business's financial practices.

It is crucial for employers to prioritize timely and accurate submission of the pd7a form to avoid these penalties and maintain compliance with tax regulations.

Quick guide on how to complete payroll remittance form v001 mak financial and tax consultants

Effortlessly Prepare Payroll Remittance Form Sample on Any Device

Online document management has become increasingly popular among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely keep it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Payroll Remittance Form Sample on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

Effortlessly Edit and Electronically Sign Payroll Remittance Form Sample

- Find Payroll Remittance Form Sample and click Get Form to begin.

- Utilize the tools available to fill out your document.

- Emphasize key sections of the documents or conceal sensitive data using tools that airSlate SignNow specifically provides for that purpose.

- Generate your electronic signature with the Sign function, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and electronically sign Payroll Remittance Form Sample to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct payroll remittance form v001 mak financial and tax consultants

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

If I don't earn enough money on social security to file income taxes, will I still need an income tax return to fill out a FAFSA, and other financial aid forms for my daughter?

No. Just provide the information requested on the form. If you later need proof you didn't file, you can get that from the IRS BY requesting transcripts.

-

I am being made redundant and my employer want me to help them fill out tax forms after I leave, can I charge them a consultancy fee for this?

You are not obligated to do work for an employer after your last date of employment. Generally, if you are asked to do work for them after you leave, you should:determine if you are interested since this will impact time you can give to a job searchbe polite however you answer because being asked to do additional work for them does reflect well on your work with themhave some idea of what you would do the work for. Unless you have access to medical or other lost benefits, you would typically expect to be paid somewhat more than you were paid in salary (because you now have to provide your own benefits). ask them to make you an offer and put it in writing including what the responsibilities will be, the dates they anticipate you will be needed, will you have to work through a contract provider, etc. Be sure this documentation includes how and on what timing you will be paid (do you have to invoice them, etc.) Once you are doing this job, work hard specifically on your responsibilities. If they ask for additional types of work, remind them politely of what your documentation requested, but indicate you'll be glad to do it as long as a change in documentation is promptly done (and you should take responsibility to make sure that happens).So, bottom line, negotiate the fee or payment and complete all the documentation before you do the work, so that everythi is clear to you and your former employer.Thanks for the A2A.

-

My company pays the TDS for the current financial year and the amount of tax was Rs. 0 because I am in the first slab. Do I still need to fill out an ITR-1 if I have Form 16 from my employer?

Receiving a Form 16 from your employer does not directly imply that you need to file an Income Tax Return. A Return has to be filed if your total income (including salary and any income from say savings bank account interest, interest income on fixed deposits, rental income) is more than the minimum income which is exempt from tax. This minimum exempt income is Rs 2,00,000 for FY 2013-14 and Rs 2,50,000 for FY 2014-15 and FY 2015-16.So you need to sum up the total income earned by you in a financial year and see if you are required to pay tax and file a Return.Return filing has several advantages too -Need a Refund – In case excess TDS has been deducted on your income and you need to claim a refund - in this situation you must file a return to claim the tax refund. For example, even though your total income is below the taxable limit, a bank deducted TDS on your FD interest - to get the refund of this TDS you'll have to file a Return.Need a Loan – When you signNow out to a bank or a financial institution for a loan a house loan or a personal loan - they usually require copies of your IT returns to check your credit worthiness. And therefore, it makes sense to keep your finances in order and file an IT return.Visas - Some countries require copies of your IT returns when they provide you a travel or a work visa.You can read more in detail here Are You required to file an IT Return in India?You'll find a lot of helpful topics here which have been addressed in very simple and easy format ClearTax's Series on Salary Income. Understand Salary Income, Deductions, Form-16Do note that if you file with http://www.cleartax.in you never have to choose which form to file since we do that for you automatically.signNow out to us support@cleartax.in if you need help!

-

Why should it be so complicated just figuring out how much tax to pay? (record keeping, software, filling out forms . . . many times cost much more than the amount of taxes due) The cost of compliance makes the U.S. uncompetitive and costs jobs and lowers our standard of living.

Taxes can be viewed as having 4 uses (or purposes) in our (and most) governments:Revenue generation (to pay for public services).Fiscal policy control (e.g., If the government wishes to reduce the money supply in order to reduce the risk of inflation, they can raise interest rates, sell fewer bonds, burn money, or raise taxes. In the last case, this represents excess tax revenue over the actual spending needs of the government).Wealth re-distribution. One argument for this is that the earnings of a country can be perceived as belonging to all of its citizens since the we all have a stake in the resources of the country (natural resources, and intangibles such as culture, good citizenship, civic duties). Without some tax policy complexity, the free market alone does not re-distribute wealth according to this "shared" resources concept. However, this steps into the boundary of Purpose # 4...A way to implement Social Policy (and similar government mandated policies, such as environmental policy, health policy, savings and debt policy, etc.). As Government spending can be use to implement policies (e.g., spending money on public health care, environmental cleanup, education, etc.), it is equivalent to provide tax breaks (income deductions or tax credits) for the private sector to act in certain ways -- e.g., spend money on R&D, pay for their own education or health care, avoid spending money on polluting cars by having a higher sales tax on these cars or offering a credit for trade-ins [ref: Cash for Clunkers]).Uses # 1 & 2 are rather straight-forward, and do not require a complex tax code to implement. Flat income and/or consumption (sales) taxes can easily be manipulated up or down overall for these top 2 uses. Furthermore, there is clarity when these uses are invoked. For spending, we publish a budget. For fiscal policy manipulation, the official economic agency (The Fed) publishes their outlook and agenda.Use # 3 is controversial because there is no Constitutional definition for the appropriate level of wealth re-distribution, and the very concept of wealth re-distribution is considered by some to be inappropriate and unconstitutional. Thus, the goal of wealth re-distribution is pretty much hidden in with the actions and policies of Use #4 (social policy manipulation).Use # 4, however, is where the complexity enters the Taxation system. Policy implementation through taxation (or through spending) occurs via legislation. Legislation (law making) is inherently complex and subject to gross manipulation by special interests during formation and amendments. Legislation is subject to interpretation, is prone to errors (leading to loopholes) and both unintentional or intentional (criminal / fraudulent) avoidance.The record keeping and forms referred to in the question are partially due to the basic formula for calculating taxes (i.e., percentage of income, cost of property, amount of purchase for a sales tax, ...). However, it is the complexity (and associated opportunities for exploitation) of taxation legislation for Use # 4 (Social Policy implementation) that naturally leads to complexity in the reporting requirements for the tax system.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the payroll remittance form v001 mak financial and tax consultants

How to make an electronic signature for your Payroll Remittance Form V001 Mak Financial And Tax Consultants online

How to generate an electronic signature for your Payroll Remittance Form V001 Mak Financial And Tax Consultants in Google Chrome

How to create an eSignature for signing the Payroll Remittance Form V001 Mak Financial And Tax Consultants in Gmail

How to make an electronic signature for the Payroll Remittance Form V001 Mak Financial And Tax Consultants right from your mobile device

How to create an electronic signature for the Payroll Remittance Form V001 Mak Financial And Tax Consultants on iOS devices

How to make an electronic signature for the Payroll Remittance Form V001 Mak Financial And Tax Consultants on Android OS

People also ask

-

What is pd7a and how does it relate to airSlate SignNow?

pd7a is a specific feature of airSlate SignNow that enables businesses to streamline their document signing process. With pd7a, users can easily send, eSign, and manage legal documents securely and efficiently. This capability helps organizations save time and improve workflow.

-

How much does airSlate SignNow cost for using pd7a?

The pricing for airSlate SignNow using the pd7a feature is competitive and offers various subscription plans. These plans are tailored to fit different business needs, whether you're a small startup or a large enterprise. You can choose the option that best suits your budget and requirements.

-

What are the main features of pd7a in airSlate SignNow?

The pd7a feature in airSlate SignNow includes document templates, real-time status tracking, and automated reminders. These features enhance the user experience by simplifying the eSigning process and ensuring that no document is overlooked. With pd7a, managing electronic signatures is truly effortless.

-

Can I integrate pd7a with other software applications?

Yes, airSlate SignNow's pd7a feature integrates seamlessly with various software applications. This allows businesses to enhance their existing workflows and improve productivity by connecting pd7a with CRM, project management, and other key tools. Integration options facilitate a comprehensive working environment.

-

What benefits can my business expect from using pd7a with airSlate SignNow?

By using pd7a with airSlate SignNow, businesses can expect improved efficiency and reduced turnaround times for document signing. This can lead to faster decision-making and increased collaboration among team members. Additionally, the cost-effectiveness of pd7a helps businesses allocate resources more wisely.

-

Is pd7a secure for handling sensitive documents?

Absolutely! airSlate SignNow's pd7a feature is designed with robust security measures to protect sensitive documents. These include encryption, secure access controls, and compliance with industry standards. You can trust pd7a to handle your documents safely and securely.

-

How easy is it to use pd7a for new users?

pd7a is designed to be user-friendly, making it easy for new users to navigate airSlate SignNow. With a straightforward interface and helpful tutorial resources, anyone can start sending and signing documents efficiently. No previous experience is required to take advantage of pd7a.

Get more for Payroll Remittance Form Sample

- New jersey unsecured installment payment promissory note for fixed rate new jersey form

- New jersey note form

- New jersey note 497319566 form

- New jersey note 497319567 form

- Notice of option for recording new jersey form

- Interrogatories compensation form

- Life documents 497319571 form

- General durable power of attorney for property and finances or financial effective upon disability new jersey form

Find out other Payroll Remittance Form Sample

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement